Fuel Economy Gov Tax Incentives . learn more and see eligible vehicles at fuel economy.gov credit amount: Department of treasury, and the internal. new and used clean vehicle tax credits. federal tax credit up to $4,000! The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. Department of energy (doe), the u.s. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. clean vehicle credits. Up to $7,500 for qualifying vehicles, which can be applied to.

from rhg.com

learn more and see eligible vehicles at fuel economy.gov credit amount: Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. Department of treasury, and the internal. Up to $7,500 for qualifying vehicles, which can be applied to. The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. clean vehicle credits. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. new and used clean vehicle tax credits. Department of energy (doe), the u.s. federal tax credit up to $4,000!

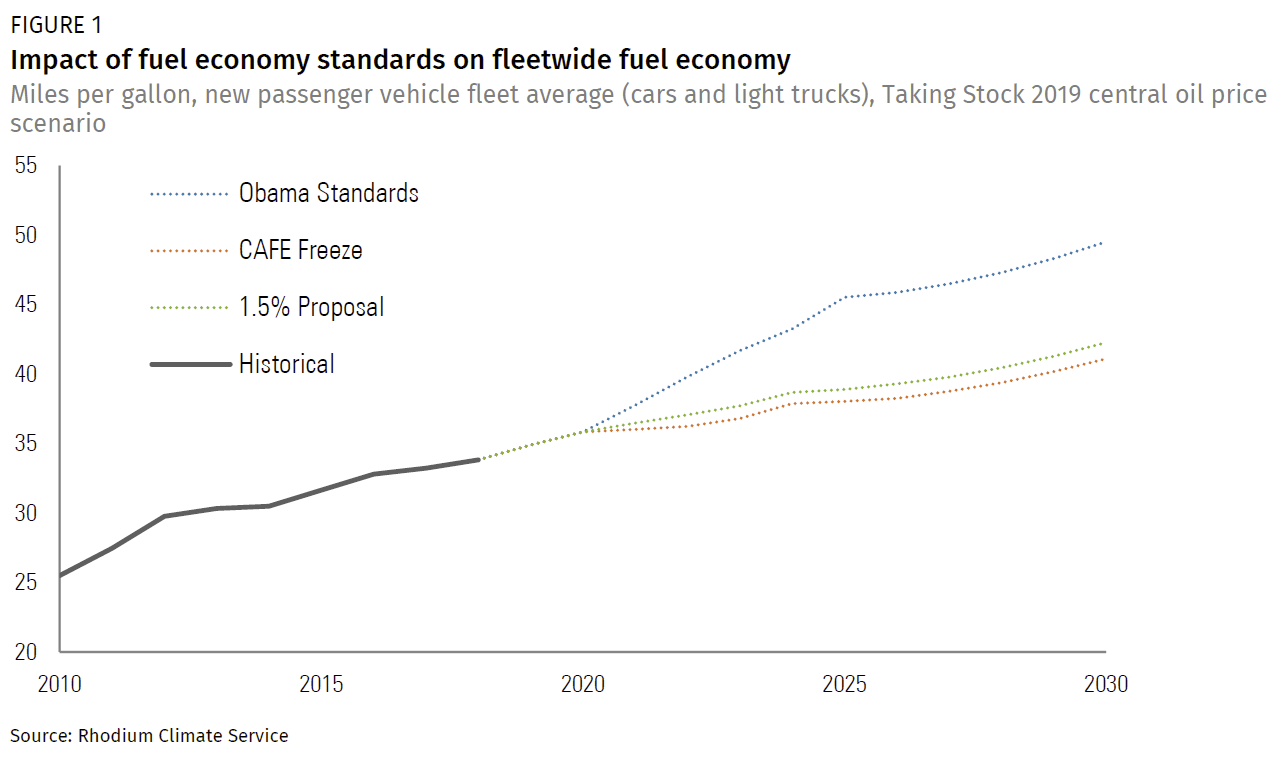

A Step Closer to a Rollback of Fuel Economy Standards Rhodium Group

Fuel Economy Gov Tax Incentives Department of energy (doe), the u.s. The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. new and used clean vehicle tax credits. federal tax credit up to $4,000! Up to $7,500 for qualifying vehicles, which can be applied to. Department of energy (doe), the u.s. learn more and see eligible vehicles at fuel economy.gov credit amount: clean vehicle credits. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. Department of treasury, and the internal. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev.

From howmuch.net

Visualizing Taxes by State Fuel Economy Gov Tax Incentives The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. Department of energy (doe), the u.s. clean vehicle credits. Determine whether your purchase. Fuel Economy Gov Tax Incentives.

From www.wardsauto.com

October Fuel Economy Up 5 WardsAuto Fuel Economy Index Fuel Fuel Economy Gov Tax Incentives Up to $7,500 for qualifying vehicles, which can be applied to. Department of energy (doe), the u.s. Department of treasury, and the internal. new and used clean vehicle tax credits. clean vehicle credits. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. learn more and see eligible vehicles at. Fuel Economy Gov Tax Incentives.

From courses.lumenlearning.com

Division of Powers Texas Government 1.0 Fuel Economy Gov Tax Incentives federal tax credit up to $4,000! Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. Up to $7,500 for qualifying vehicles, which. Fuel Economy Gov Tax Incentives.

From www.taxpolicycenter.org

What tax incentives encourage energy production from fossil fuels Fuel Economy Gov Tax Incentives new and used clean vehicle tax credits. federal tax credit up to $4,000! learn more and see eligible vehicles at fuel economy.gov credit amount: The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. Up to $7,500 for qualifying vehicles, which can be applied to. Determine whether your purchase of. Fuel Economy Gov Tax Incentives.

From rcocweb.org

Where the Money Goes Road Commission for Oakland County Fuel Economy Gov Tax Incentives Department of energy (doe), the u.s. learn more and see eligible vehicles at fuel economy.gov credit amount: The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the. Fuel Economy Gov Tax Incentives.

From www.fueleconomy.gov

Help Promote Fuel Economy Fuel Economy Gov Tax Incentives Department of treasury, and the internal. new and used clean vehicle tax credits. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev.. Fuel Economy Gov Tax Incentives.

From www.nytimes.com

How U.S. Fuel Economy Standards Compare With the Rest of the World’s Fuel Economy Gov Tax Incentives learn more and see eligible vehicles at fuel economy.gov credit amount: The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. Up to $7,500 for qualifying vehicles, which can be applied to. Department of treasury, and the internal. clean vehicle credits. new and used clean vehicle tax credits. Determine whether. Fuel Economy Gov Tax Incentives.

From nbu.bg

Epa Fuel Economy Label Fuel Economy Gov Tax Incentives new and used clean vehicle tax credits. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. federal tax credit up to $4,000! learn more and see eligible vehicles at fuel economy.gov credit amount: Determine whether your purchase. Fuel Economy Gov Tax Incentives.

From kleinmanenergy.upenn.edu

Ending Fossil Fuel Tax Subsidies Kleinman Center for Energy Policy Fuel Economy Gov Tax Incentives Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. federal tax credit up to $4,000! find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. Department of energy (doe), the u.s. . Fuel Economy Gov Tax Incentives.

From www.signnow.com

CDTFA 501 DG Government Entity Diesel Fuel Tax Return Form Fill Out Fuel Economy Gov Tax Incentives Up to $7,500 for qualifying vehicles, which can be applied to. new and used clean vehicle tax credits. clean vehicle credits. federal tax credit up to $4,000! Department of treasury, and the internal. learn more and see eligible vehicles at fuel economy.gov credit amount: Department of energy (doe), the u.s. The inflation reduction act (ira) provides. Fuel Economy Gov Tax Incentives.

From www.cbc.ca

What you need to know Federal carbon tax takes effect in Ont Fuel Economy Gov Tax Incentives Department of energy (doe), the u.s. Department of treasury, and the internal. new and used clean vehicle tax credits. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. federal tax credit up to $4,000! find out if your home, business, or facility is in an eligible location for tax. Fuel Economy Gov Tax Incentives.

From www.investopedia.com

Fuel Tax Credit Definition Fuel Economy Gov Tax Incentives clean vehicle credits. Department of treasury, and the internal. federal tax credit up to $4,000! Up to $7,500 for qualifying vehicles, which can be applied to. learn more and see eligible vehicles at fuel economy.gov credit amount: new and used clean vehicle tax credits. Department of energy (doe), the u.s. Determine whether your purchase of an. Fuel Economy Gov Tax Incentives.

From www.edmunds.com

The EPA Unveils New Fuel Economy Labels Edmunds Fuel Economy Gov Tax Incentives learn more and see eligible vehicles at fuel economy.gov credit amount: new and used clean vehicle tax credits. find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. Department of treasury, and the internal. clean vehicle credits. . Fuel Economy Gov Tax Incentives.

From www.parisfinancial.com.au

Changes to fuel tax credit rates Paris Financial Accounting And Fuel Economy Gov Tax Incentives The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. federal tax credit up to $4,000! Department of treasury, and the internal. learn more and see eligible vehicles at fuel economy.gov credit amount: find out if your home, business, or facility is in an eligible location for tax credits that. Fuel Economy Gov Tax Incentives.

From www.globalfueleconomy.org

Thailand introducing new EcoSticker and CO2 based taxation scheme to Fuel Economy Gov Tax Incentives Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. Up to $7,500 for qualifying vehicles, which can be applied to. Department of treasury, and the internal. new and used clean vehicle tax credits. . Fuel Economy Gov Tax Incentives.

From www.ornl.gov

Electric vehicles dominate list of efficient cars in 2022 Fuel Economy Fuel Economy Gov Tax Incentives Department of treasury, and the internal. Department of energy (doe), the u.s. learn more and see eligible vehicles at fuel economy.gov credit amount: find out if your home, business, or facility is in an eligible location for tax credits that could save up to 30% off the cost of installing ev. federal tax credit up to $4,000!. Fuel Economy Gov Tax Incentives.

From www.taxpolicycenter.org

What tax incentives encourage energy production from fossil fuels Fuel Economy Gov Tax Incentives Department of treasury, and the internal. new and used clean vehicle tax credits. learn more and see eligible vehicles at fuel economy.gov credit amount: Department of energy (doe), the u.s. Determine whether your purchase of an electric vehicle (ev) or fuel cell vehicle (fcv) qualifies for a. clean vehicle credits. Up to $7,500 for qualifying vehicles, which. Fuel Economy Gov Tax Incentives.

From www.express.co.uk

E10 fuel Petrol alternative launch in UK in September despite Fuel Economy Gov Tax Incentives federal tax credit up to $4,000! clean vehicle credits. new and used clean vehicle tax credits. The inflation reduction act (ira) provides new opportunities for consumers to save money on clean vehicles, offering. Department of treasury, and the internal. Department of energy (doe), the u.s. find out if your home, business, or facility is in an. Fuel Economy Gov Tax Incentives.